Jaideep Saraswat, Nikhil Mall

Two-wheelers have long been the backbone of personal transportation in many parts of the world, including India. Their compact size, ease of maneuverability, and high fuel efficiency make them an ideal choice for both congested urban centers and sparsely populated rural areas. The global two-wheeler market is substantial and growing, reaching US$ 130.0 billion in 2023 and expected to expand to around USD 230.7 billion by 2030[1].

The two-wheeler market is diverse, encompassing two main form factors: motorcycles (bikes) and scooters. These are further categorized by their transmission systems:

- Motorcycles (bikes): Typically feature manual transmission and are the most popular globally.

- Scooters: Generally equipped with automatic transmission, offering ease of use especially in urban settings.

In terms of fuel type, petrol remains the dominant choice for two-wheelers worldwide. However, as we’ll explore, electric powertrains are gaining traction in this sector.

India, in particular, has a deep-rooted two-wheeler culture. Over the past decade, two-wheelers have accounted for 75% of total vehicle sales in the country[2]. This dominance persists, with two-wheelers representing approximately 71.26% of all vehicles sold in the FY 2023-24.

As the world shifts towards sustainable transportation, electric two-wheelers are gaining traction. In India, the government has been actively promoting the transition to low-emission vehicles, including electric vehicles (EVs), CNG[3], and other alternative fuel technologies. This push has led to a growing market for electric two-wheelers, which accounted for 6% of total two-wheeler sales in India during the 2023-24 fiscal year[4].

Despite this progress, the adoption rate of electric two-wheelers in India presents an intriguing paradox. These vehicles have already achieved Total Cost of Ownership (TCO) parity with their conventional counterparts, making them economically attractive. Moreover, both central and state governments have introduced numerous fiscal and non-fiscal incentives to promote their adoption. The market also boasts around more than 66[5] Original Equipment Manufacturers (OEMs), including both legacy brands and startups, offering a wide range of options to consumers[6].

Given these favorable conditions, one might expect a higher market penetration of electric two-wheelers. This discrepancy between potential and actual adoption rates makes it crucial to analyze the market and discern the reasons for this difference. This blog will explore various aspects of the electric two-wheeler market in India, including an analysis of models, range, ex-showroom prices, and more.

The electric two-wheeler market in India is rapidly evolving, as evidenced by our analysis of 236 models from 66 OEMs in this category. It reveals a market heavily skewed towards scooters, with 194 scooter models compared to just 42 motorcycle models[7]. This composition suggests a strong focus on urban commuting and short-distance travel in the current market landscape. Additionally, there is a growing demand for scooter models by logistics companies for e-commerce and quick commerce in the commercial space.

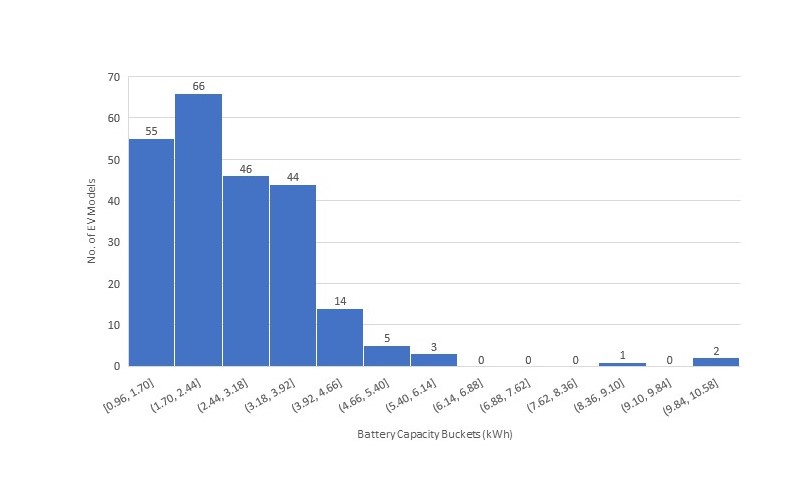

In terms of model diversity, KLB leads the pack with 18 models, closely followed by Yakuza Electric Vehicles with 15 models. This variety of options indicates a highly competitive market where manufacturers are striving to cater to diverse consumer needs. The battery capacity of the vehicles ranges from a minimum of 0.96 kWh (seen in the Flash LX model by Hero Electric) to a maximum of 10.3 kWh (in the Mach 2 model by Ultraviolette). However, the average battery capacity stands at 2.66 kWh, with the majority of models (about 66) falling in the 1.7-2.44 kWh range. This distribution is notably right-skewed, with only a few models boasting battery capacities above 5 kWh, suggesting that manufacturers are primarily focusing on lower to mid-range capacities to balance cost and performance as seen in Figure 1.

A closer look at the market reveals interesting distinctions between scooters and motorcycles. Scooters, on average, come with a battery capacity of 2.48 kWh and an ex-showroom price of around INR 94,000. In contrast, motorcycles offer larger battery capacities, averaging 3.47 kWh, and command a higher average price of INR 133,000. This disparity can be attributed partly to the presence of about 12 scooter models using lead-acid batteries, which are cheaper but offer lower capacity. Moreover, motorcycles may be designed for longer ranges and higher performance, justifying their higher battery capacities and prices.

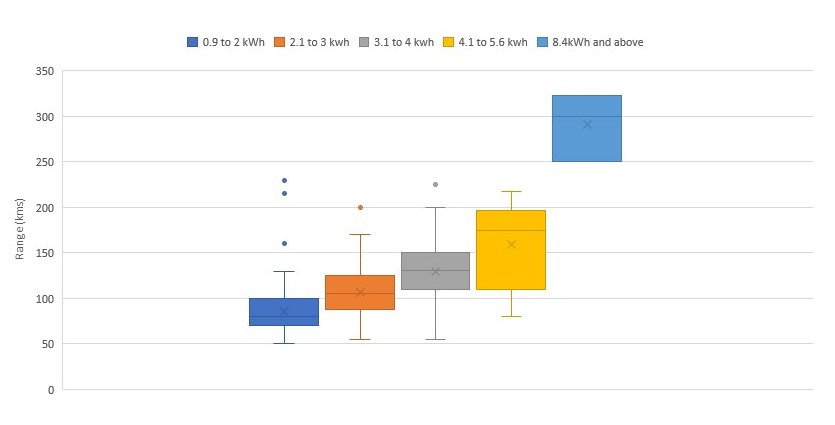

The analysis of range distribution across different battery capacity buckets unveils some intriguing patterns. For smaller battery capacities, the distribution is right-skewed, where median range value is closer to box’s lower values and the upper whisker is longer as seen in Figure 2. This trend raises questions about the accuracy of the range claims, especially given the presence of several outliers quoting ranges 1.5 times the interquartile range. Such variability poses challenges for consumers in selecting vehicles that will meet their real-world needs. Interestingly, this pattern flips for larger battery buckets, where the distribution becomes left-skewed, suggesting more conservative range estimates for higher-capacity models.

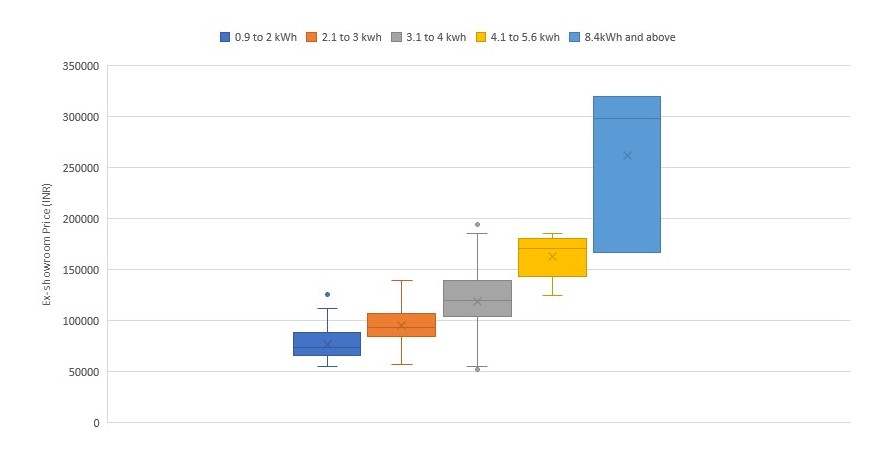

A similar pattern emerges when examining the relationship between battery capacity and ex-showroom prices as seen in Figure 3. This correlation between range, price, and battery capacity is expected, but the presence of outliers and skewed distributions indicates that other factors, such as brand value, features, or market positioning, also play significant roles in pricing strategies. Of late, features have become a crucial aspect of vehicles, with innovative additions like reverse mode, automatic SMS replies to emergency contacts with current location while driving, ping my scooter, tow and theft alerts, fall safety, and more than can balloon prices.

These findings highlight several challenges and implications for the electric two-wheeler market in India. The wide variability in range and price, especially for lower battery capacities, makes it difficult for consumers to make informed decisions and increases the risk of disappointment if real-world performance doesn’t match claimed figures. This, in turn, can dampen the momentum that the EV sector has gained over the past few years. This situation underscores the need for more transparent and standardized performance metrics across the industry.

From a regulatory perspective, the analysis points to the necessity of stronger oversight. There’s a clear need for standardized testing procedures for range and performance, validation of manufacturer claims, and clearer guidelines on how range and performance should be communicated to consumers. On top of this, the low-speed models, which are significant in the 194 list, should also receive equal attention from the government to ensure compatibility with standards and inclusion of safety features.

Despite these challenges, the presence of 66 OEMs with multiple models indicates a rapidly evolving market with intense competition. This diversity can drive innovation but may also lead to market consolidation as the industry matures. As the market continues to evolve, we can expect further refinements in technology, more accurate performance claims, and potentially a shift towards higher capacity models as battery technology improves and costs decrease.

[1] https://www.imarcgroup.com/two-wheeler-market

[2] https://vahan.parivahan.gov.in/vahan4dashboard/

[3] https://www.indiatoday.in/auto/story/bajaj-freedom-125-cng-motorcycle-launch-at-rs-95000-nitin-gadkari-rajiv-bajaj-2562820-2024-07-05

[4] https://iced.niti.gov.in/

[5] This blog focuses only on OEMs that have sold a minimum of 50 units in the last financial year.

[6] https://evreadyindia.org/

[7] All data points used for this analysis were sourced from their respective websites.