Jaideep Saraswat, Nikhil Mall, Tushar Katiyar

The electrification of the road transport sector is experiencing significant growth, driven by various factors such as the declining cost of batteries, the expanded deployment of charging infrastructure, favorable policy incentives at both central and state levels, increasing consumer awareness, and more. India has set an ambitious target of achieving at least a 30% share of electric vehicle (EV) sales by 2030. As of August 2023, approximately 2.9 million EVs have been registered in India, with the majority of sales occurring in the 2 and 3-wheeler segments. Presently, India boasts a thriving EV industry with over 640 manufacturers, including 159 specializing in electric 2-wheelers and around 460 focusing on electric 3-wheelers.

It’s crucial to emphasize that the shift toward EVs is causing significant disruptions throughout the entire automotive industry supply chain. One area experiencing the most substantial impact is the highly profitable automotive aftersales market, which can be divided into three main segments: spare parts, accessories, and customer service.

Firstly, the spare parts business is witnessing a decline in demand as EVs have fewer mechanical and moving components compared to traditional vehicles. Also, the mortality rate of these parts is way higher than existing vehicles.

Secondly, the accessories business is experiencing only minor disruptions, with limited effects on this segment.

However, the customer service segment faces significant challenges. This includes the need for specialized technical equipment for fault detection, technician training, and the reduced demand for servicing EVs due to their simpler mechanics.

Within the customer service segment, there are three types of workshops: regulated aftermarket workshops, independent large workshop chains, and independent small roadside workshops. Notably, small to medium-sized repair shops are encountering difficulties because they lack the necessary technical expertise and financial resources to adapt to the changing landscape. Without appropriate training and financial support, these shops may find themselves primarily handling tasks such as chassis painting and repair, as well as accessory replacements like windshields, wipers, tires, and headlights, while missing out on the evolving EV service market.

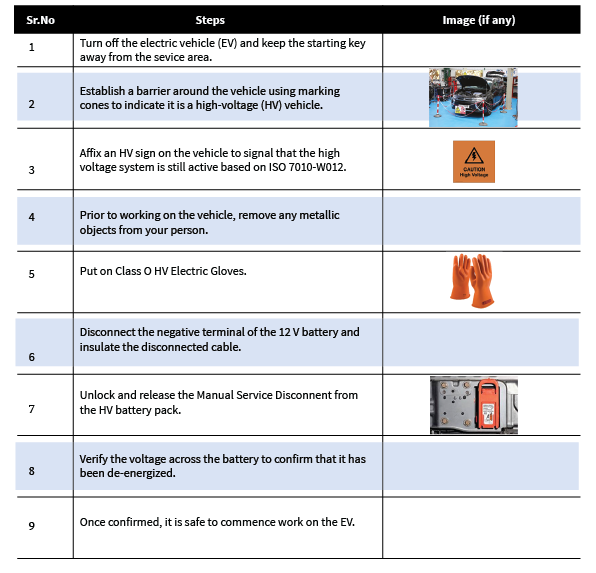

To perform even these tasks, these repair shops must first undergo fundamental training to handle high-voltage EVs. This article offers standard operating procedures (SOPs) for technicians to work safely with high-voltage (HV) EVs. Additionally, the article briefly introduces fault diagnostics in EVs.

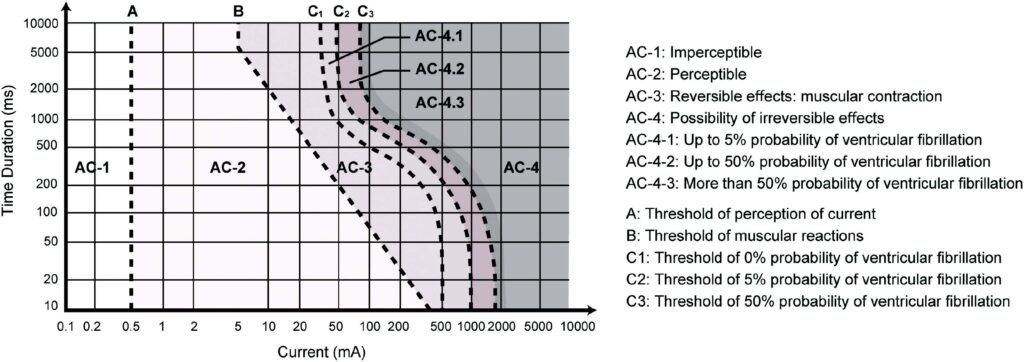

To find the SOP ensuring the safety of technicians working with HV EVs, please consult Table 1. In accordance with ISO 6469-3, vehicles falling under voltage class ‘B,’ which operate on DC voltage ranging from 60 V to 1500 V or AC voltage within the range of 30 V to 1500 V, are classified as HV vehicles. Improper handling of these vehicles can introduce electrical hazards for technicians.

When a current exceeding 10 mA flows through flexor muscles, it results in sustained muscle contractions, escalating the severity of the electrical shock. Conversely, when the current passes through extensor muscles, it induces violent spasms. Figure 1 illustrates the effects of AC currents.

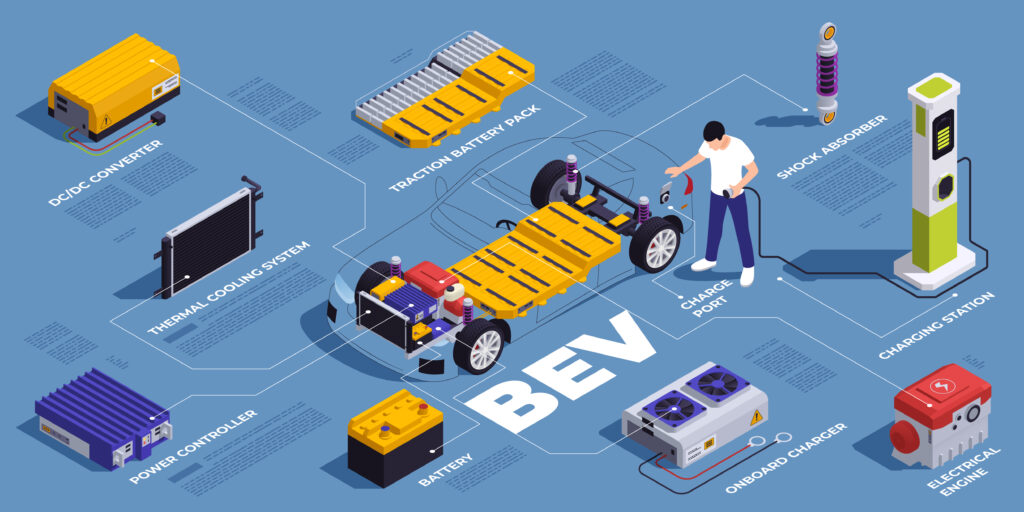

In terms of fault identification, the EVs have complex self-diagnostic systems that are beyond Onboard Diagnostic Devices (OBD)-II that are there in ICE vehicles, and the service professionals are equipped to handle them. This is majorly because, like ICE vehicles, the EVs are not mandated to comply with OBD-II DLC connector standards or use the OBD-II CAN communication protocol. For example, in the case of batteries, there is a Battery Management System (BMS) that monitors all the aspects related to batteries like voltage, current, and temperature and deduces State of Charge (SoC), State of Health (SoH), and more. This BMS comes in several architectures like Central, Distributed, String, Hierarchical, etc., each suitable for various applications. For motors, there is a Motor Current Signature Analysis (MCSA) tool for fault diagnosis.

However, certain systems within EVs have the capability to trigger Diagnostic Trouble Codes (DTC) and activate the Malfunction Illumination Lamp (MIL). One such system is the HV Interlock Circuit, which alerts when there’s a disconnection in the HV connectors across the system. When this DTC code is generated, the technician can then proceed to locate and address the disconnection issue.

Another critical system is the HV Isolation Fault Detection System. In some EVs, advanced diagnostic systems regularly conduct Isolation Resistance checks for both the DC and AC sides. Nevertheless, technicians should remain proficient in using an Insulation Tester to identify and rectify isolation faults within each HV equipment.

These instances underscore the significance of training for service technicians and emphasize the necessity for support from both central and state governments to the automotive customer service sector to make this transition.