Parul Babbar, Rahul Patidar and Vrinda Gupta

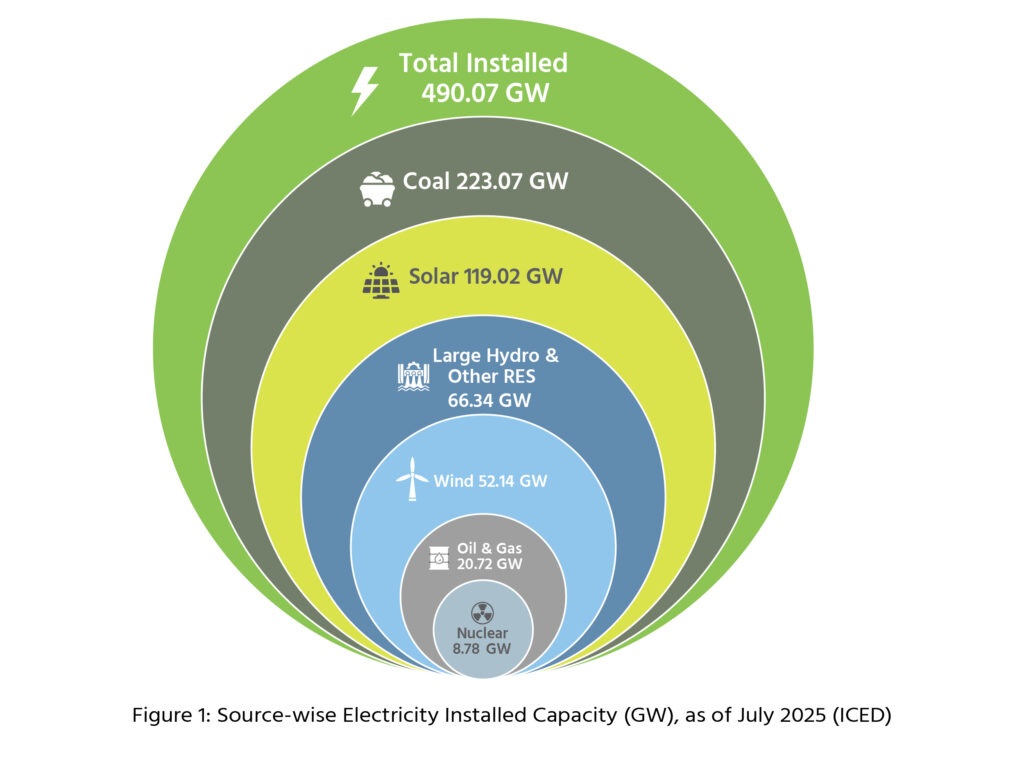

Coal power continues to be the backbone of India’s electricity sector, currently accounting for 223.07 GW or 45.52% of the nation’s total installed capacity as of July 31, 2025 (Figure 1). It remains the dominant source of electricity generation, producing over 436.57 Billion Units (BU) and contributing more than 65% to the country’s total output India Climate & Energy Dashboard (ICED).

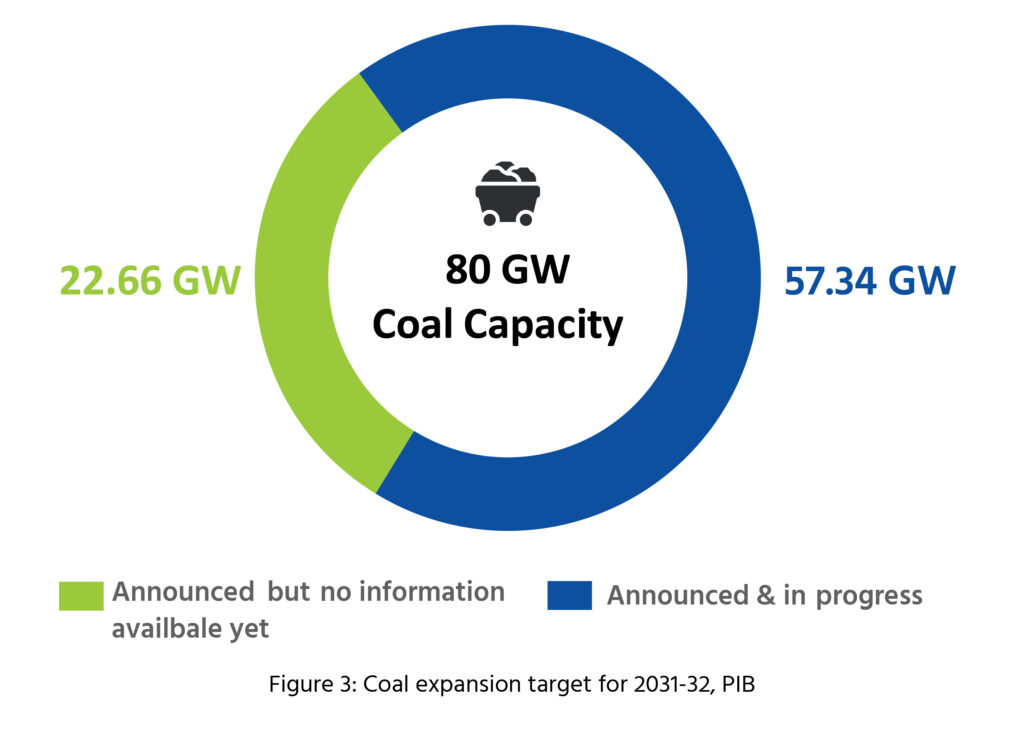

In 2024, India’s electricity peak demand surged to 250 GW and is projected to rise sharply, reaching 273 GW in 2025, 297 GW by 2026-27, and 366 GW by 2031-32. To address this rising demand and maintain reliable base load power, the Central Electricity Authority (CEA) has recommended expanding the existing 223 GW of coal and lignite-based capacity to 283 GW by 2032. In line with this, the Government of India proposed adding at least 80 GW of new coal-based capacity by the end of 2031-32.

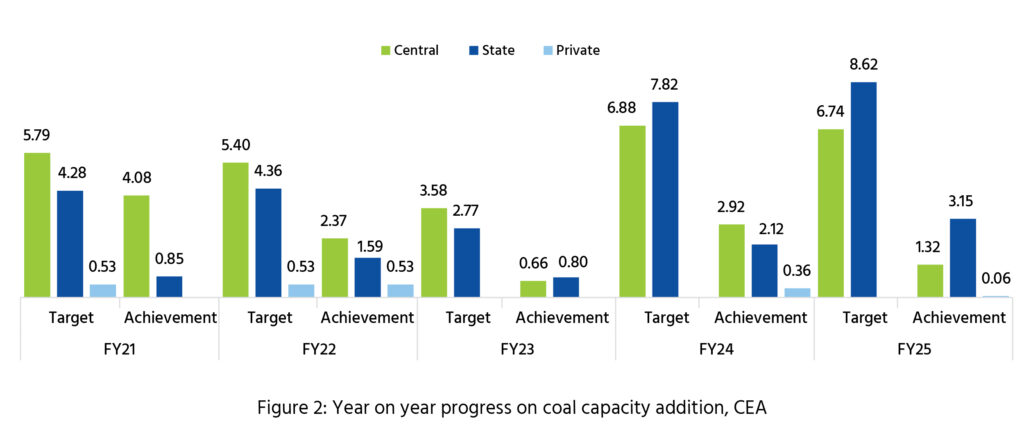

Yet, despite these ambitious plans, the ground reality paints a contrasting picture. Over the past five years, coal capacity additions have consistently fallen short across all sectors, Central, State, and Private. In FY25, planned state-owned coal capacity additions fell significantly short, with only 3.2 GW commissioned against a target of 8.6 GW. Similarly, the Centrally owned coal capacities achieved a mere 20% of their target. The Private sector, despite having no formal target, contributed 0.06 GW (Figure 2).

These shortfalls are not one-off setbacks but the outcome of deep-rooted and recurring challenges ranging from delays in land acquisition and financial hurdles to issues with environmental clearances and technical problems. Further, a growing cost competitiveness of firm renewable energy sources is indeed contributing to a slowdown in the growth of new coal-based capacity addition.

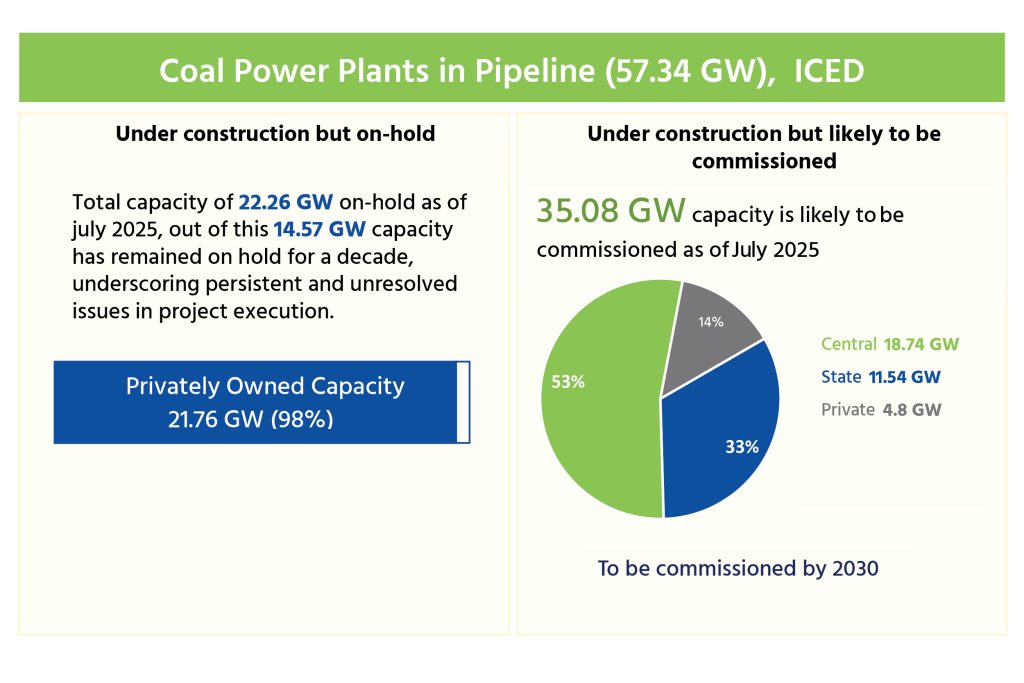

Coal Power in the Pipeline: At a Glance

CEA monitors coal-based thermal power projects through its monthly Broad Status of Thermal Power Projects report, categorising them as ‘Under-construction & likely to be commissioned’ & ‘Under-construction but On-hold’. The report offers detailed insights on project capacity, location, progress, finances, and delays, supporting realistic timeline assessments. As of now, a total of 57.34 GW is in the pipeline—22.26 GW has remained on hold since 2011, while 35.08 GW is expected to be commissioned by 2030 (ICED).

Coal Capacity Expansion Challenges: Stalled Projects and State-Level Delays

Despite coal’s critical role and the government’s goal to add 80 GW of coal capacity by 2031-32, the sector is experiencing commissioning delays due to various on-ground factors. As previously mentioned, only 57.34 GW is currently in the pipeline and no official announcements regarding the remaining 22.66 GW. Of this 57.34 GW, nearly 61% (35.08 GW) faces significant technical, financial, and environmental challenges, hindering timely commissioning as elaborated further. These challenges are evident in the numerous coal-fired power plant units currently under construction across various states. Addressing these bottlenecks remains a priority, given coal’s pivotal role in ensuring India’s energy security.

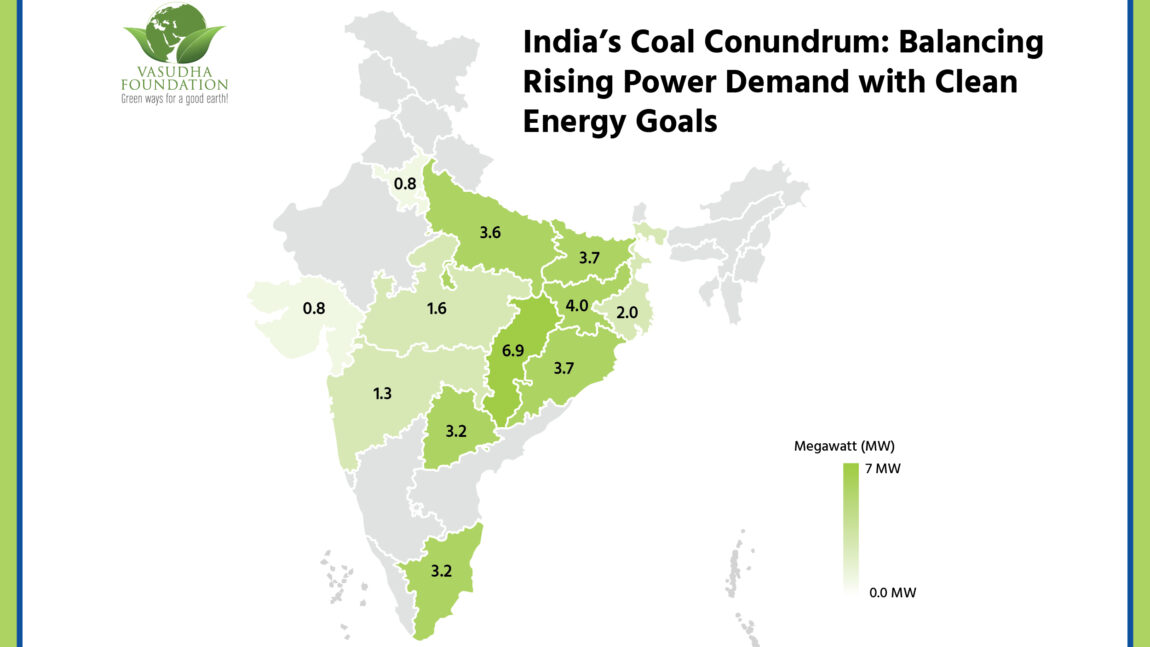

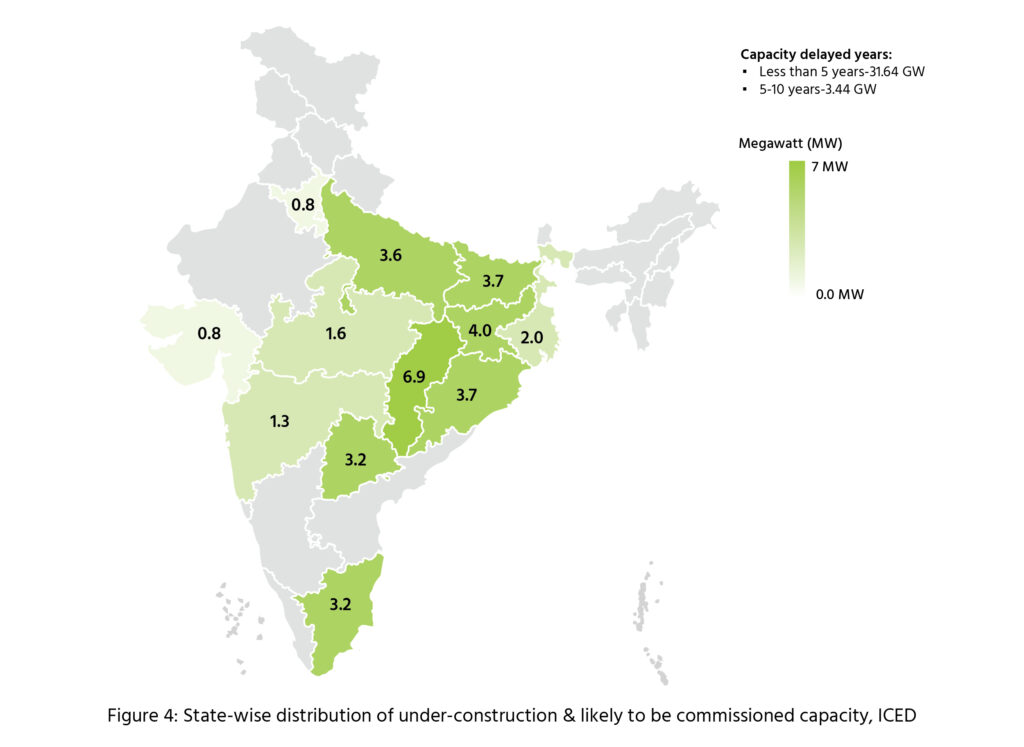

Chhattisgarh has the maximum under-construction power plant units with 6.9 GW of coal capacity, followed by Jharkhand, Bihar, Odisha, Uttar Pradesh & Tamil Nadu, together accounting for more than 70% of the total nations under construction capacity.

Nevertheless, significant delays persist in several states. A total of 31.64 GW of capacity has experienced delays for under five years, with an additional 2.44 GW remaining pending for close to ten years now.

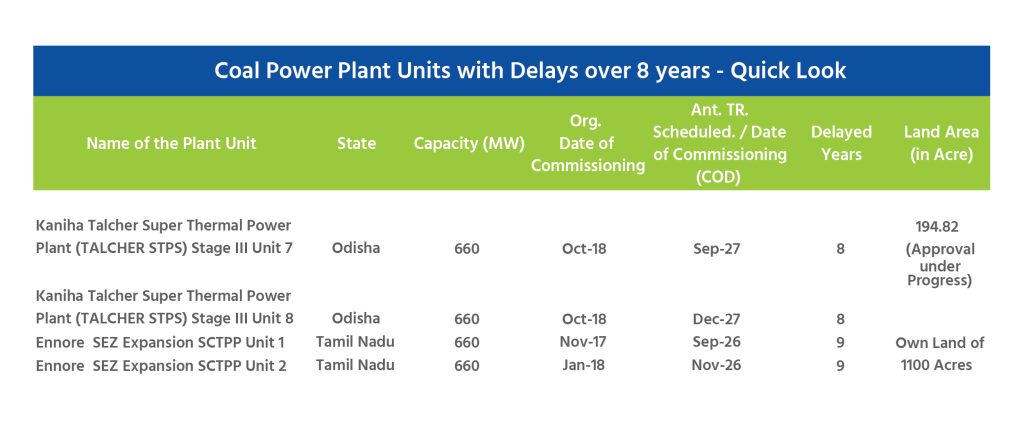

States like Odisha, Tamil Nadu and Bihar are facing delays for more than five years. Plant units like Kaniha Talcher Super Thermal Power Plant Stage III Unit 7&8 in Odisha and Ennore SEZ expansion TPP Unit 1&2 in Tamil Nadu have been in the pipeline for more than 8 years.

Much surprisingly, Bihar’s Barh Super Thermal Power Project (STPP) Stage I, Unit 3, after enduring 13 years of construction delays primarily due to technical challenges, was finally commissioned in June 2025.

Notably, these plants are of supercritical as well as ultra-supercritical technology type which are designed for higher efficiency and lower emissions.

Reasons for Consistent Delay in the commissioning of plants

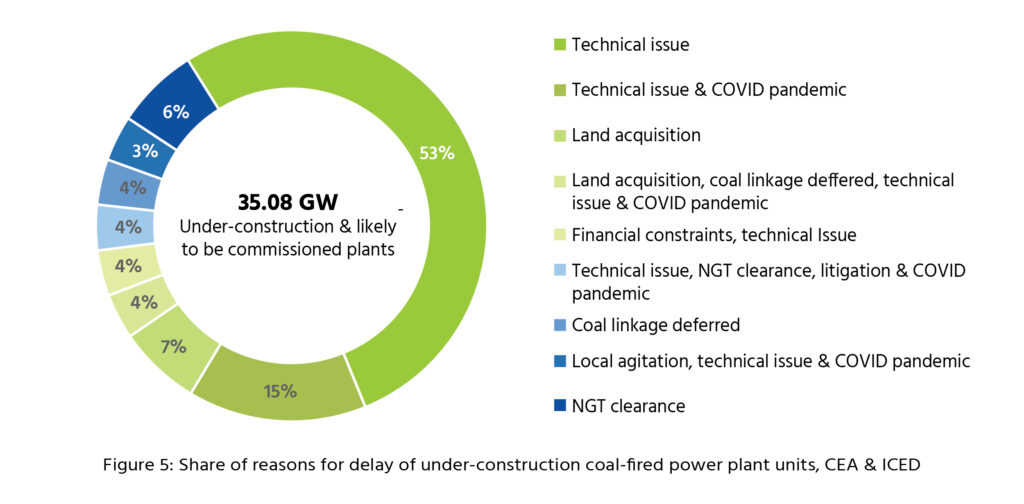

Some of the dominant reasons over the years for delay in the construction of the power plants include technical issues, deferred coal linkages, land acquisition challenges, financial constraints, local agitation, litigation, pending clearances from the National Green Tribunal, and disruptions caused by the COVID-19 pandemic (Figure 4).

Among these, technical issues have emerged as the most widespread cause of delay. While some plants face delays solely due to technical setbacks, others are affected by a combination of challenges. These technical issues often include slow progress in Balance of Payment, delay in the completion of Electro Static Precipitator and Flue Gas Desulfurisation works. In addition to technical challenges, other major contributors to commissioning delays include land acquisition challenges, the impact of the pandemic and financial limitations.

Conclusion:

To meet India’s rising power demand, coal remains indispensable, as it continues to hold the largest share of the electricity sector and serve as its backbone. However, the current trajectory of capacity addition highlights deep structural challenges. Despite the government’s plan to add 80 GW of new coal capacity, only 57.34 GW is currently in the pipeline. The remaining 22.66 GW or 28% of the planned coal capacity expansion remains ambiguous, with no official announcements on project details, timeline, size or location.

This uncertainty combined with the recurring delays due to technical issues, financial constraints, land acquisition problems, and delay in environmental clearances, raises concerns about the reliability of future coal capacity. Further, prolonged project delays have highlighted two-fold challenges, on one hand, it leads to elevated costs and financial strain for project developers and investors; on the other, these delays have led to large parcels of land lying idle and underutilised, adding further economic strain. It is critical to overcome these challenges through streamlined clearances, improved financing mechanisms and strengthen project monitoring & holdings, to achieve the capacity targets on time.

Without greater clarity and pragmatic project planning, India risks both supply shortfalls and stranded investments. Coal capacity additions need to be better planned and transparently tracked at a regular basis. This involves resolving the information gap on unclear projects, expediting approvals, strengthening financing, and aligning project timelines with demand forecasts.