Jaideep Saraswat, Nikhil Mall & Tushar Katiyar

Why EV insurance needs a fresh lens?

With over 69 lakh electric vehicles (EVs) registered in India today, adoption is accelerating at a rapid pace, driven by lower running costs, government incentives, and growing awareness. But as with any innovation, new technologies also bring new complexities. These aren’t flaws in EVs – they are simply the realities of driving a vehicle that is more advanced, digitally connected, and energy-dependent than its predecessors.

This is why it’s important to look at EV insurance differently. Traditional motor insurance was designed for the age of gears, engines, and exhaust systems. But EVs run on batteries, sensors, chargers, and software – assets that behave very differently from mechanical parts. Protecting them requires interventions that are just as forward-looking as the technology itself.

Far from being a drawback, this actually represents a chance to build a smarter, more resilient insurance ecosystem. One that not only shields EV owners from unexpected costs but also supports confidence in the broader EV revolution. By recognizing EV-specific risks without exaggerating them, insurers can create solutions that sustain momentum toward sustainable mobility.

The current scenario: What most EV owners get

Right now, most EV owners purchase:

- Third-party insurance (mandatory by law): Covers damage or injury to others, but not your vehicle.

- Comprehensive insurance: Covers theft, accidents, natural disasters, and fire.

- Personal accident cover: Compulsory coverage for driver/owner injuries.

The problem is the common misconception that ‘comprehensive insurance means complete security’. In reality, it does not. Key EV-specific risks like battery failure, charger damage, or electronic control system breakdowns are not covered under a standard comprehensive policy.

The gaps that leave EV owners vulnerable

Even with comprehensive insurance, EV owners remain exposed to:

- Battery replacement costs (₹5-₹15 lakh depending on vehicle model)

- Charger damage at homes (₹50,000-₹2 lakh for high-capacity chargers)

- Software or motor control unit failures

- Electrical surge or short-circuit damage

- Breakdowns in remote areas without roadside assistance

It’s difficult to ignore that a single battery replacement or charger breakdown can easily erase the cost savings that initially made switching to EVs appealing.

Basic vs best EV insurance

These gaps make one thing clear: having insurance doesn’t automatically mean you’re fully protected. While most owners settle for the minimum (third-party + comprehensive cover), this leaves out protection for the most expensive and vulnerable components of the vehicle.

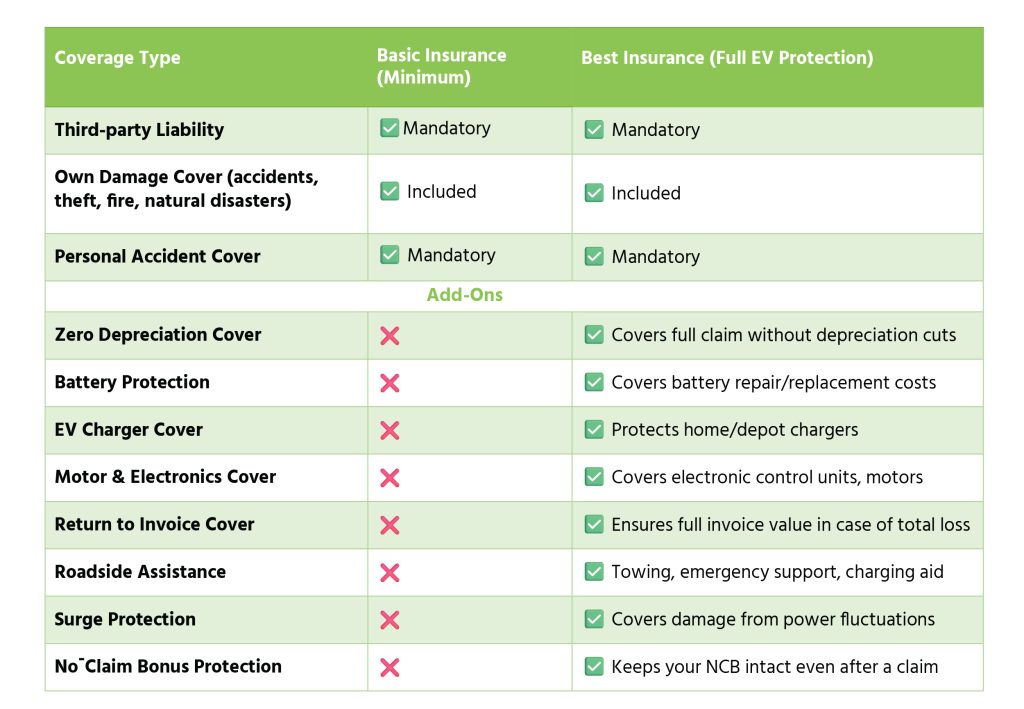

That’s where EV-specific add-ons come in – from battery and charger protection to roadside assistance and electronic surge coverage. The goal isn’t to take every possible add-on, but to carefully select the ones that cover the most essential risks for your vehicle or fleet. The table below breaks down the difference between a basic EV insurance package and a comprehensive, well-protected policy:

To understand how EV insurance differs from conventional coverage, consider a mid-range electric car priced around ₹17 lakh. A standard comprehensive insurance plan typically covers third-party liability and accidental damages caused by incidents such as fire, floods, earthquakes, riots, or even rodent attacks, costing about ₹40,000 annually. However, such policies usually exclude battery-specific issues like waterlogging damage, short circuits, or electronic failures. Adding a dedicated battery protection cover comes at an additional cost of roughly ₹3,500–₹4,000 per year, an important safeguard given the high expense of repairing or replacing a battery pack. Similarly, damage to the home charging station due to theft or burglary, impact damage caused by external accidental means, fire, explosion, self-ignition, etc., is not covered under a regular plan, but can be insured through an add-on costing around ₹2,500. This demonstrates how a relatively small increase (~15%) in annual premium can provide peace of mind by covering some of the most critical and costly EV components*.

With growing awareness among dealerships and the wider availability of such offerings from insurance providers, consumers are now being informed about these add-ons and their benefits. Ultimately, it is up to the buyers to opt for them in order to secure comprehensive protection for their EVs.

Conclusion

As EV adoption accelerates in India, protecting your investment goes beyond just buying a vehicle – it means choosing the right insurance. While insurance costs vary depending on the manufacturer and vehicle model, the example above highlights how essential it is to carefully review what each policy and add-on covers. Unlike conventional ICE vehicles, where mechanical repairs are the primary concern, EVs rely on electronics, software, and high-value components that require specialized protection. It’s important for consumers to be aware of these nuances and choose insurance packages that address their vehicle’s specific risks, rather than assuming that standard coverage is sufficient. A well-chosen policy today can safeguard your EV and your peace of mind for years to come.

[*]The information has been cross-verified with insurers and dealerships