The recently concluded India-European Union (EU) Free Trade Agreement (FTA) marks a decisive moment for India’s textile and apparel sector. With zero-duty access across all textile and apparel lines, Indian manufacturers now enjoy a long-awaited level playing field in one of the world’s largest and most sophisticated consumer markets.

With the FTA in force, India’s textile and apparel exports to the EU, currently estimated at around USD 7 billion, are expected to scale to USD 30-40 billion over time. The expected export expansion under the FTA is likely to be anchored in India’s existing textile clusters, including apparel hubs in Tamil Nadu, Haryana, and home-textiles and man-made fiber centers in Gujarat, alongside other established production regions.

Beyond Tariffs: Climate Readiness in Europe’s Textile Market

For India’s Micro, Small, and Medium Enterprises (MSMEs or SMEs), which form the backbone of textile value chain, this agreement opens up unprecedented market opportunities. Yet, as the European market opens wider, the rules of competition are also changing. Price competitiveness is no longer sufficient. Carbon intensity, fuel choices, and clean production practices now shape sourcing decisions by European buyers. Europe’s textile market is among the most climate-regulated globally. Over the last decade, the EU has steadily embedded sustainability into its trade architecture through policies on carbon disclosure, product sustainability, circularity, and supply-chain due diligence. Measures such as Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), Eco-design for Sustainable Products Regulation (ESPR), and EU Strategy for Sustainable and Circular Textiles, each of which applies to products placed on the European market, are not just temporary hurdles, but are structural features of Europe’s future market. Going forward, most European fashion brands shall ensure their suppliers are conducting due diligence to bring corporate practices in line with the Paris Agreement on Climate goals and that the workers and communities are protected from the adverse effects of their operations.

Process Heat: The Core Emissions Challenge in Textile Manufacturing

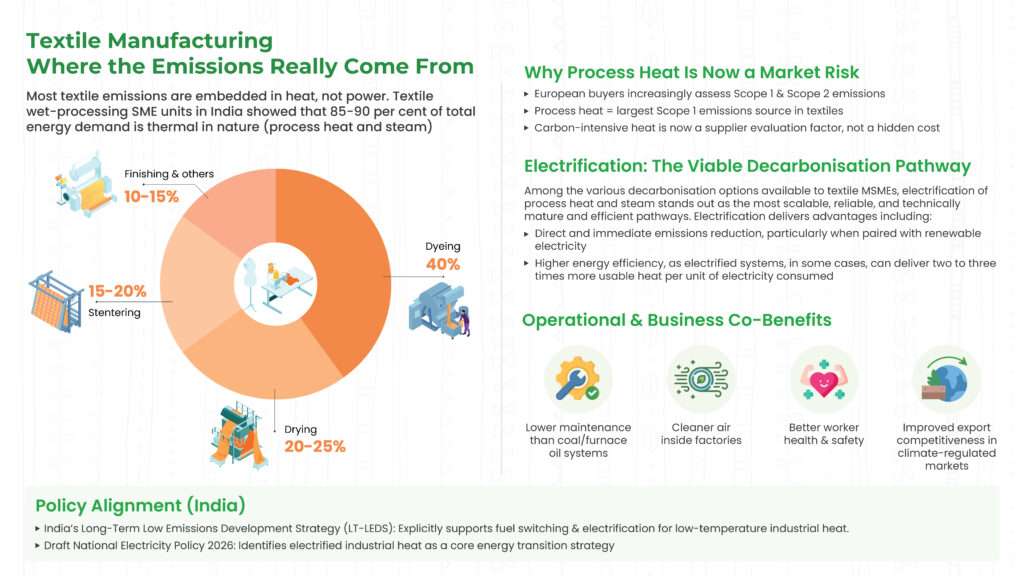

As climate expectations increasingly shape access to the European market, the emissions profile of textile manufacturing is drawing increased attention. In textile manufacturing, the bulk of emissions originate not from electricity use, but from the generation of thermal energy for process heat and steam.

Dyeing, printing, and finishing of textile fabrics rely heavily on continuous and high-volume heat, traditionally supplied through coal, furnace oil, diesel, or natural gas in most Asian markets. Our recent assessments of textile wet-processing SME units in India showed that 85-90 per cent of total energy demand is thermal in nature, with electricity accounting for only a small share of overall energy use. Among these processes, dyeing alone accounts for nearly 40 per cent of total energy consumption, followed by drying, stentering, and finishing.

For SMEs, these systems are often fuel-intensive, inefficient, volatile in operating cost and emission-intensive. As European buyers scrutinise Scope 1 and Scope 2 emissions across their supply chains, the carbon footprint embedded in process heat is no longer invisible, but an explicit factor in supplier evaluation.

Electrification: The Decarbonisation Pathway

Decarbonising textile manufacturing therefore requires a fundamental shift in how process heat and steam are produced. Among the various decarbonisation options available to textile SMEs, electrification of process heat and steam stands out as the most scalable, reliable, and technically mature and efficient pathway.

India’s Long-Term Low Emissions Development Strategy (LT-LEDS) explicitly recognises fuel switching and electrification for low-temperature industrial heating, a direction further reinforced in the recently released Draft National Electricity Policy 2026, which identifies electrifying industrial heat using clean electricity as a fundamental strategy to achieve India’s low carbon energy targets.

Process-level analysis shows that a substantial share of textile heat demand lies in the low-to-medium temperature range (below 2000C). These temperature ranges are well suited to existing electrification technologies such as industrial heat pumps and electric boilers. Washing, pre-treatment, dyeing, and certain finishing operations can be served efficiently by heat pumps, while higher temperature requirements can be met through electric boilers or hybrid configurations.

Electrification delivers multiple advantages including:

- Direct and immediate emissions reduction, particularly when paired with renewable electricity

- Higher energy efficiency, as electrified systems convert electricity into usable heat far more efficiently and in some cases can deliver two to three times more usable heat per unit of electricity consumed

- Lower maintenance requirements compared to conventional fossil fuel-fired systems

- Co-benefits such as cleaner local air, healthier and safer working conditions, and enhanced attractiveness in climate-regulated export markets

Unlike fossil fuels, which face persistent price and supply risks, electrification enables greater long-term cost predictability, particularly as corporate renewable power procurement and green energy open-access options expand.

The Competitive Window for Textile SMEs

Large, vertically integrated exporters in India may have the capital and institutional capacity to navigate Europe’s sustainability transition. SMEs, which account for nearly 80 per cent of India’s textile capacity, however, face a more complex challenge. Without timely support and technology shifts, they face growing risks of:

- being excluded from preferred suppliers list

- facing pricing pressure linked to higher carbon intensity

- losing access to long-term sourcing contracts

As demand rises with the India-EU FTA in force, European buyers will consolidate sourcing around suppliers that can demonstrate clean, transparent, and future-ready production systems. In this context, electrification enables SMEs to move beyond short-term price competition toward becoming strategic, lower-risk suppliers, creating a significant opportunity for India’s labor-intensive textile sector to integrate clean energy and low-carbon production practices and expand its presence in the European market.

From Compliance to Competitiveness

Climate readiness is no longer peripheral to trade. As access to the European market expands, clean production becomes the anchor that allows Indian SMEs to grow without losing competitiveness in a climate-regulated market. Electrification, in this context, provides a pathway that aligns operational efficiency with evolving European standards, while reducing long-term exposure to cost, regulatory, and supply-chain risks.

Authored By: Vrinda Gupta, Associate Director – Energy Transition and Director Strategy and Innovations & Srinivas Ethiraj Assistant Manager – Energy Transition at Vasudha Foundation