Jaideep Saraswat, Nikhil Mall

The electric vehicle (EV) market in India has undergone a transformative leap in the past couple of years, redefining how mobility is perceived. EV penetration in 2025 has already touched 7.8%, up from 5.6% just two years ago. In absolute numbers, India sold more than 20 lakh EVs in FY 2024-25, underlining the accelerating shift toward cleaner mobility.

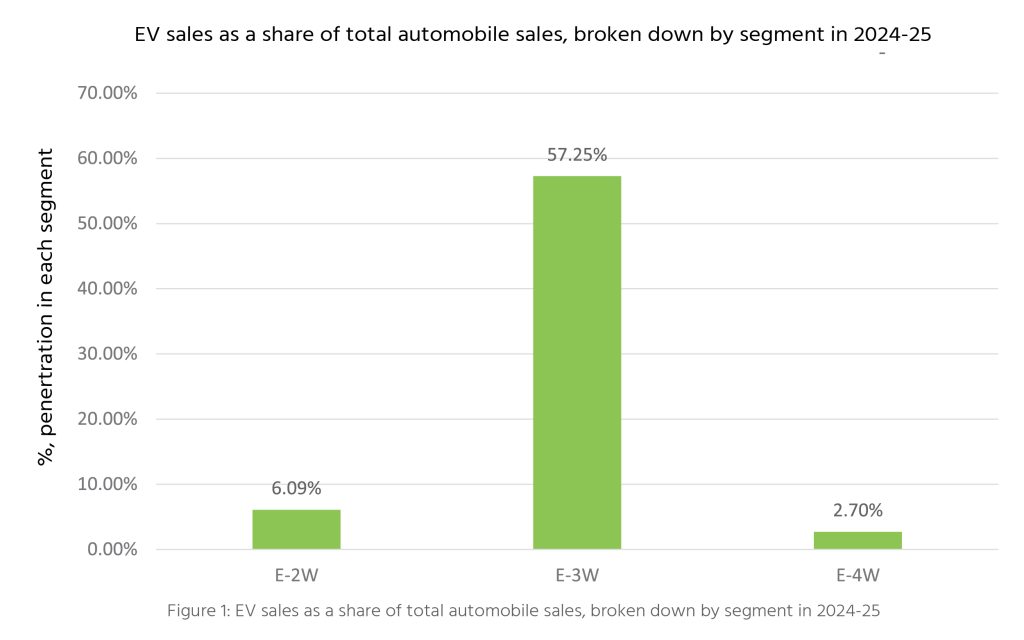

Two-wheelers and three-wheelers have spearheaded this growth, with penetration reaching 6.09% and 57.25% respectively (Figure 1). The three-wheeler segment, in particular, has become a frontrunner. In the passenger L5 category, penetration has reached 23.72%, while in goods carriers it stands at 21.98%. Despite financing challenges, adoption continues to rise as business owners increasingly recognise the long-term savings and operational efficiency EVs bring, especially in high-usage urban and peri-urban markets.

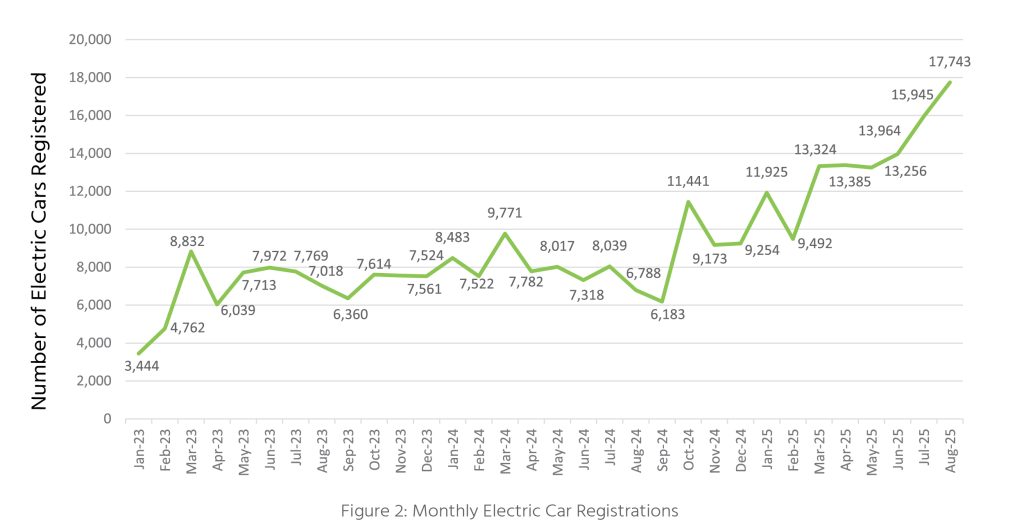

The two-wheeler segment, which accounts for the majority of India’s vehicle sales, has also seen a sharp uptick in EV adoption due to the increasing availability of diverse models tailored to consumer needs. Battery-as-a-service models, introduced by reputed OEMs, have eased upfront cost concerns, while assured buyback programs provide certainty on resale value, boosting consumer confidence. In the four-wheeler space, penetration is still modest at 2.7% in FY 2024-25, but momentum is undeniable. Monthly electric car registrations in India reached a record high of 17,734 units in August 2025 (Figure 2), reflecting the growing adoption of EVs among Indian consumers. During the same month, electric cars achieved their highest-ever market penetration at 5.4%, marking a significant milestone in buyer interest and acceptance.

The rise in electric car sales can be attributed to a confluence of factors:

- Supportive central and state-level policies that encourage both supply and demand.

- Falling battery costs, which reduce overall vehicle prices.

- Rapid improvements in technology, particularly in range and charging speeds.

- Increased awareness among consumers, fueled by both government campaigns and industry-driven initiatives.

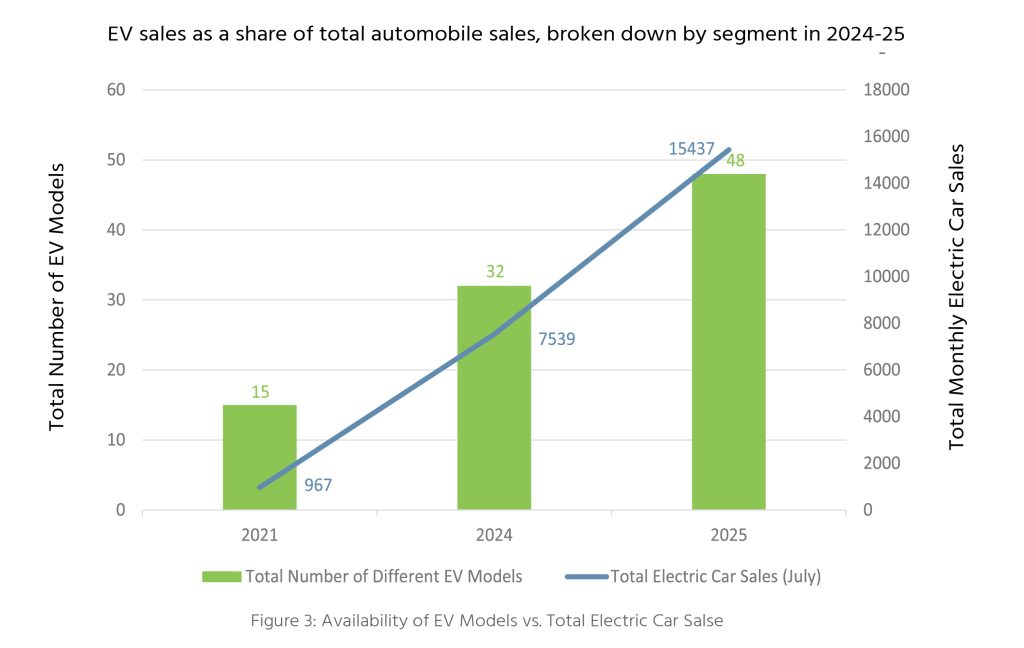

However, one of the most critical and often underappreciated factors is the rapid increase in the number of EV models available. In August 2025 alone, consumers could choose from 48 distinct electric car models (Figure 3). These options were offered by approximately 17 different OEMs. It’s important to note that these were unique models, not just trims or variants of the same model.

The data highlights a strong positive correlation (Pearson coefficient 0.96) between the number of models available and total sales. While the limited number of observations makes statistical significance harder to establish, the relationship is clear: greater consumer choice translates into higher adoption. A similar global pattern is observed, with the number of electric car models rising from 680 in 2023 to 785 in 2024, accompanied by a 15% year-over-year increase in sales, reaching 17 million units.

This expansion of model variety signals more than just market diversification. It reflects the confidence of OEMs in the technology’s maturity and long-term potential. By investing in new models, manufacturers are effectively telling consumers that EVs are here to stay. This confidence is also visible in the persistence of Indian OEMs that led from the front—Tata Motors being the most notable for its early and sustained EV push. The momentum has been further reinforced by the entry of Maruti Suzuki, the long-standing leader of India’s car market, with its first electric offering. While its launch did not immediately translate into a surge in sales, it undeniably generated buzz and signaled that EVs are no longer a niche play but a mainstream inevitability. Rivalries such as the one emerging between VinFast and Tesla in India around design and features are also reshaping consumer expectations, creating tailwinds into the market.

At the same time, as more OEMs and models enter the market, companies are compelled to invest in awareness campaigns, consumer education, and charging infrastructure support, further lowering barriers to adoption. Moreover, with a growing number of OEMs adopting the BaaS model in electric car segment, upfront costs will decrease, similar to the two-wheeler segment, providing the much-needed boost for the market.

Looking ahead, this interplay between consumer choice, OEM confidence, policy support, technology maturity, and awareness-building will be the key driver of EV adoption. Together, these elements will help India stay on track to achieve its ambitious goal of 30% new EV sales by 2030.