Jaideep Saraswat, Nikhil Mall

The growth of Electric Vehicles (EVs) is evident, with consumer interest increasing year-on-year. Various surveys conducted by several agencies validate this trend[1]. However, the growth rate varies significantly across different segments. For instance, EV sales penetration is highest in the three-wheeler segment at 54%, followed by the two-wheeler segment at 6%, and the four-wheeler segment at 2%. Notably, segments with lower EV sales penetration also have high personal ownership percentages[2], indicating that consumers purchasing vehicles for personal use are still not fully convinced. The reasons for this reluctance differ starkly between the two-wheeler and four-wheeler segments.

This blog is the first in a two-part series, examining electric four-wheelers, the available models, their range, and more. The next part will be on electric two-wheelers.

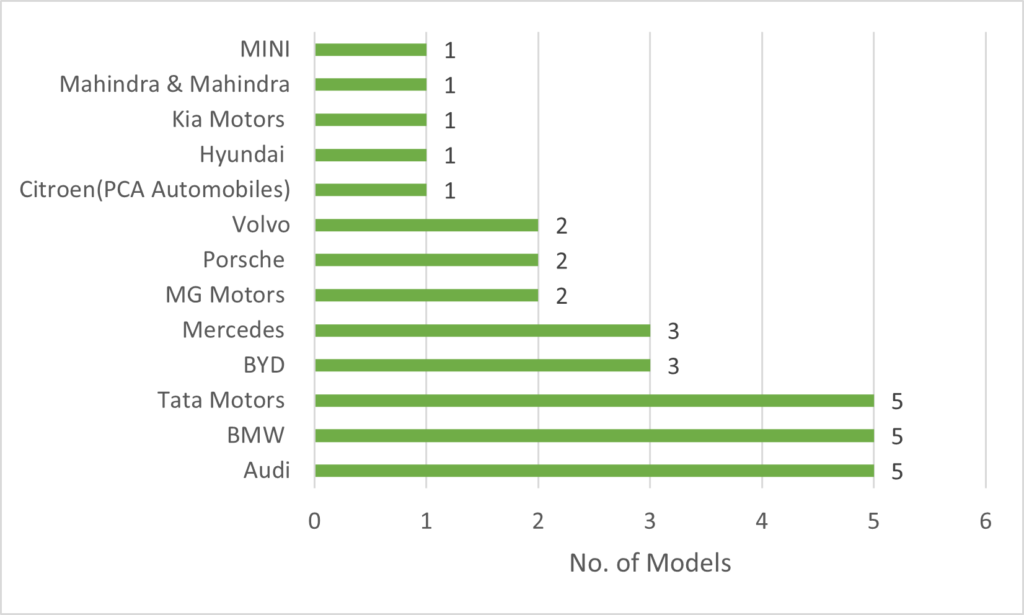

As of July 2024, there are 13 Original Equipment Manufacturers (OEMs) active in India with at least one EV model. This includes two homegrown OEMs, Tata Motors and Mahindra & Mahindra. Interestingly, Maruti Suzuki, the largest market share holder in the personal car segment in India, has yet to launch an EV model[3]. The total number of EV models available in the Indian market has grown to around 32, up from 15 in 2021. Tata Motors, BMW, and Audi lead with five models each as seen in Figure 1.

Figure 1: Number of EV Models from Various OEMs

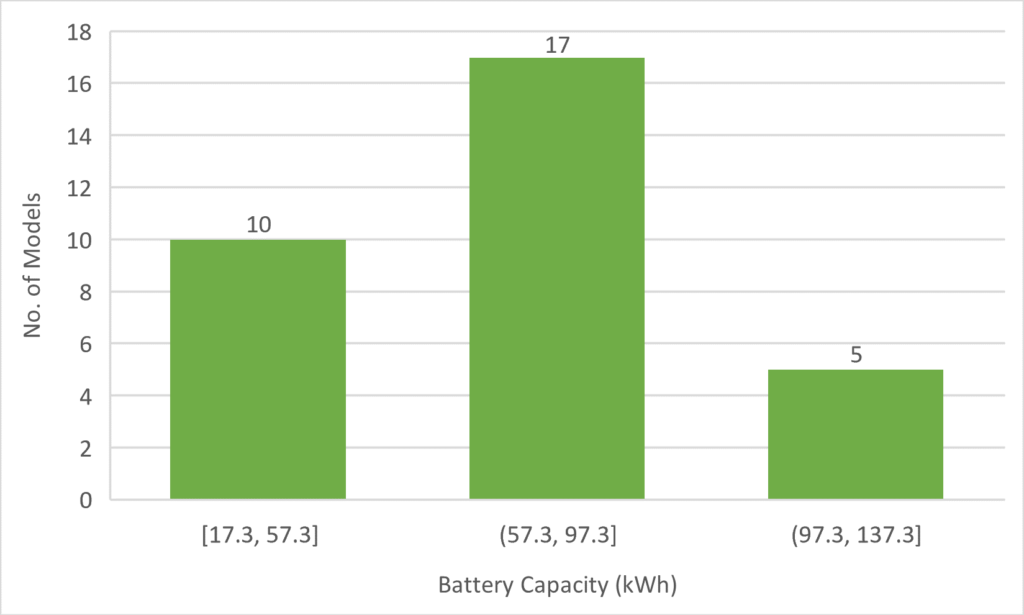

Regarding vehicle characteristics, the average battery capacity available in the Indian market is around 69.5 kWh. The lowest capacity is provided by the MG Comet at 17.3 kWh, while the highest is offered by the Audi Q8 e-tron at 114 kWh. The majority of models (17) fall within the 57.3 to 97.3 kWh range, followed by 10 models in the 17.3 to 57.3 kWh range as seen in Figure 2. And as battery size increases, so does the cost, limiting options for cost-conscious consumers in India.

Figure 2: Number of EV Models Across Different Battery Capacity Ranges

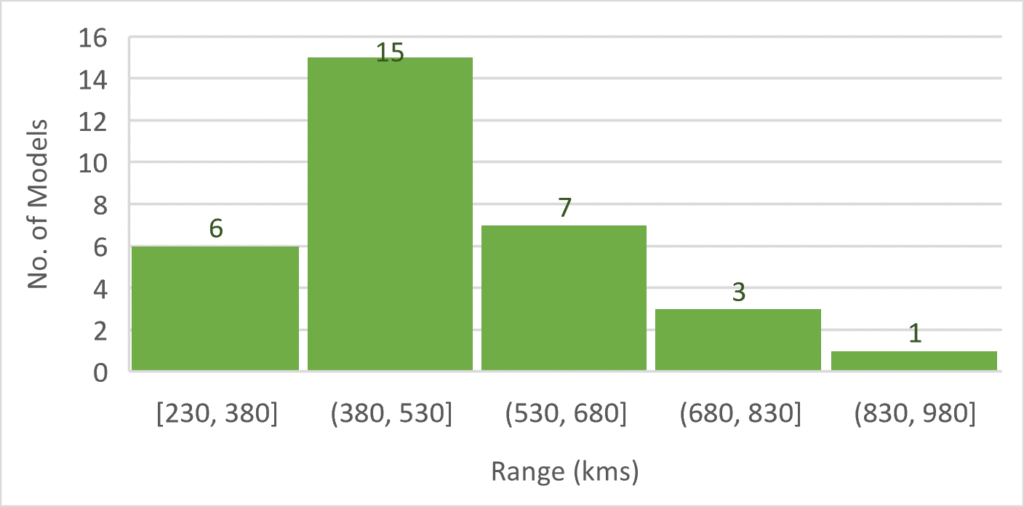

In terms of range, the average range offered by EVs in India is approximately 492 km. The MG Comet offers the lowest range at 230 km, while the Mercedes EQS Limousine provides the highest at 857 km. It’s important to note that these ranges are based on different test cycles, which have varying testing parameters, leading to different results. Additionally, the real-world range may differ due to factors like geography, terrain, temperature, and driving behavior. Nonetheless, using the provided ranges for analysis, we see that only six models fall within the 230 – 380 km range as seen in Figure 3. According to Deloitte’s Global Automotive Consumer Study 2024, around 50% of surveyed consumers in India expect a range of 200 – 400 km for them to prefer EVs[4]. This indicates a need for more models within this range to offer consumers more choices.

Figure 3: Driving Range for EV Models

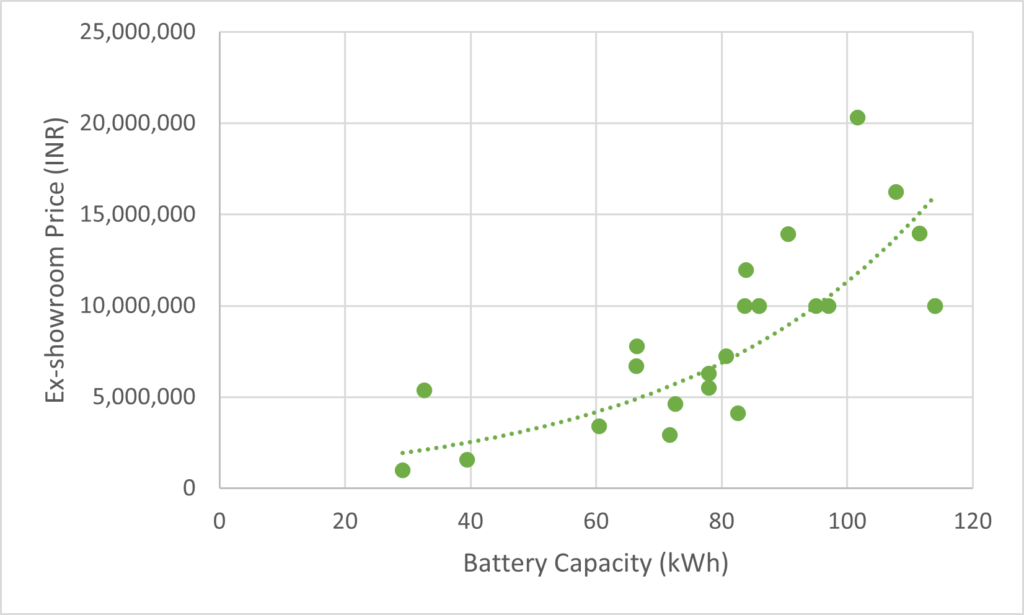

Regarding price, the average ex-showroom price for an EV in India is INR 69.83 lakh. The minimum price is for the MG Comet, while the highest is for the BMW i7. Interestingly, even though another EV model has a higher battery capacity, the BMW i7 still commands a higher price. This highlights the non-linear relationship between battery capacity and vehicle cost.

Several factors contribute to this non-linearity. Luxury brands like BMW often include premium features, advanced technology, and superior build quality, which significantly increase the overall cost. Additionally, factors such as brand value, performance capabilities, and additional amenities can drive up the price beyond what battery capacity alone would suggest. Figure 4 illustrates this complexity, showing how vehicle costs can escalate due to these varied influences.

Figure 4: Relationship Between Price and Battery Capacity of EVs

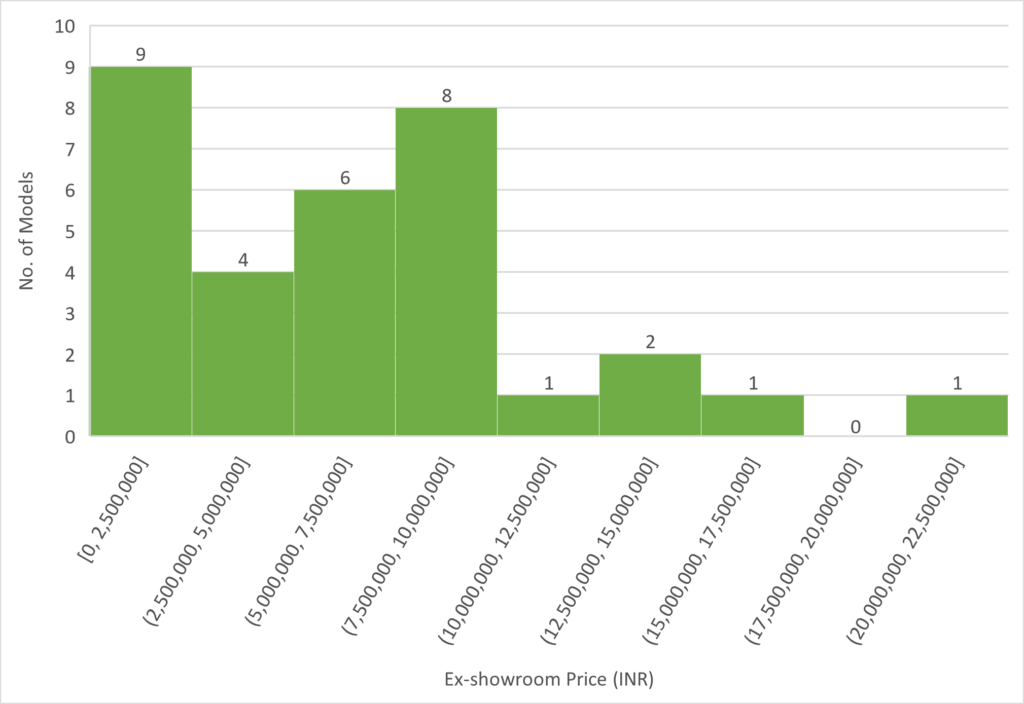

Moreover, vehicle affordability is a critical factor for Indians, with 80% of potential EV buyers willing to spend less than INR 25 lakh[5]. This highlights the disparity between the availability of EVs and consumer expectations. Additionally, the under INR 25 lakh segment has only nine EV models, reinforcing the lack of choices for consumers as seen in Figure 5.

Figure 5: Number of Models and their Price Ranges

While charging time and infrastructure remain key concerns for consumers, the lack of availability of models that meet their capacity needs is also a significant issue. To accelerate the adoption of EVs, manufacturers must diversify their offerings, particularly in the more affordable segments. Providing a wider range of options within the 200 – 400 km range, which aligns with consumer expectations, could make EVs more appealing to a broader audience. Additionally, increasing the number of models under INR 25 lakh would cater to the cost-sensitive nature of the Indian market.

[1] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[2] https://www.team-bhp.com/forum/indian-car-scene/251900-infographic-percentage-households-owning-car-bike-each-indian-state.html

[3] https://www.motorbeam.com/maruti-plans-6-new-electric-vehicles-by-2031/

[4] https://www2.deloitte.com/content/dam/Deloitte/in/Documents/consumer-business/in-consumer-business-deloitte-gacs-report-2024-india-noexp.pdf

[5] https://www2.deloitte.com/content/dam/Deloitte/in/Documents/consumer-business/in-consumer-business-deloitte-gacs-report-2024-india-noexp.pdf